LIFE INSURANCE

World-Class Service, On Your Terms

Let’s be real…life insurance isn’t your favorite topic. But protecting your people? Now we’re talking.

We made life insurance quick, affordable, and (dare we say) painless. We took the confusing, paperwork-heavy process and made it make sense. No jargon. No pressure. Just three simple steps to peace of mind.

UNDERSTANDING

Our Process

Step One

Tell us about yourself

Your age, budget, and what you’re protecting. That’s it.

→ No phone calls. No appointments.

Step Two

Get your options instantly

We compare top-rated carriers to find plans that fit.

→ Most people don’t need a medical exam.

Step Three

Apply & relax

Pick what works, apply online, and you’re covered—fast.

→ Coverage can start in minutes.

We Put You First

The traditional life insurance approval process could take weeks to complete-and that’s just the application. It could involve confusing paperwork and long phone calls with agents. At the end of the day, it wasn’t as people-friendly as it could be. We’ve changed that. Real Innovation has redesigned the application process from start to finish, to make sure you always come first. By offering flexible coverage options, eliminating unnecessary hassles, giving you access to valuable online tools, and having a team of licensed agents ready to help you through it all.

Qualify for Life Insurance Online Without Speaking to an Agent

The “pure term life insurance” Offers coverage amounts from $50K up to max of $1M of coverage and 100%

instant decision

The “accidental death” offers $50K to $300K in coverage, is guaranteed issue and extends coverage options to clients aged 20 to 59. This is great affordable coverage that will cove any

accidental death.

The “guaranteed issue” offers guaranteed acceptance final expense for clients aged 50-85 with no health questions, builds cash value and offers coverage amounts of $5K to $25K. Easy application with and

guaranteed acceptance.

World Class Service, on Your Terms

Protecting your family’s financial future means finding the life insurance policy that meets your unique needs and goals. Whether you have recently purchased a home, taken a new job, or welcomed a newborn into your family, your life and your loved ones are worth protecting. Real Innovation is life insurance tailored to you.

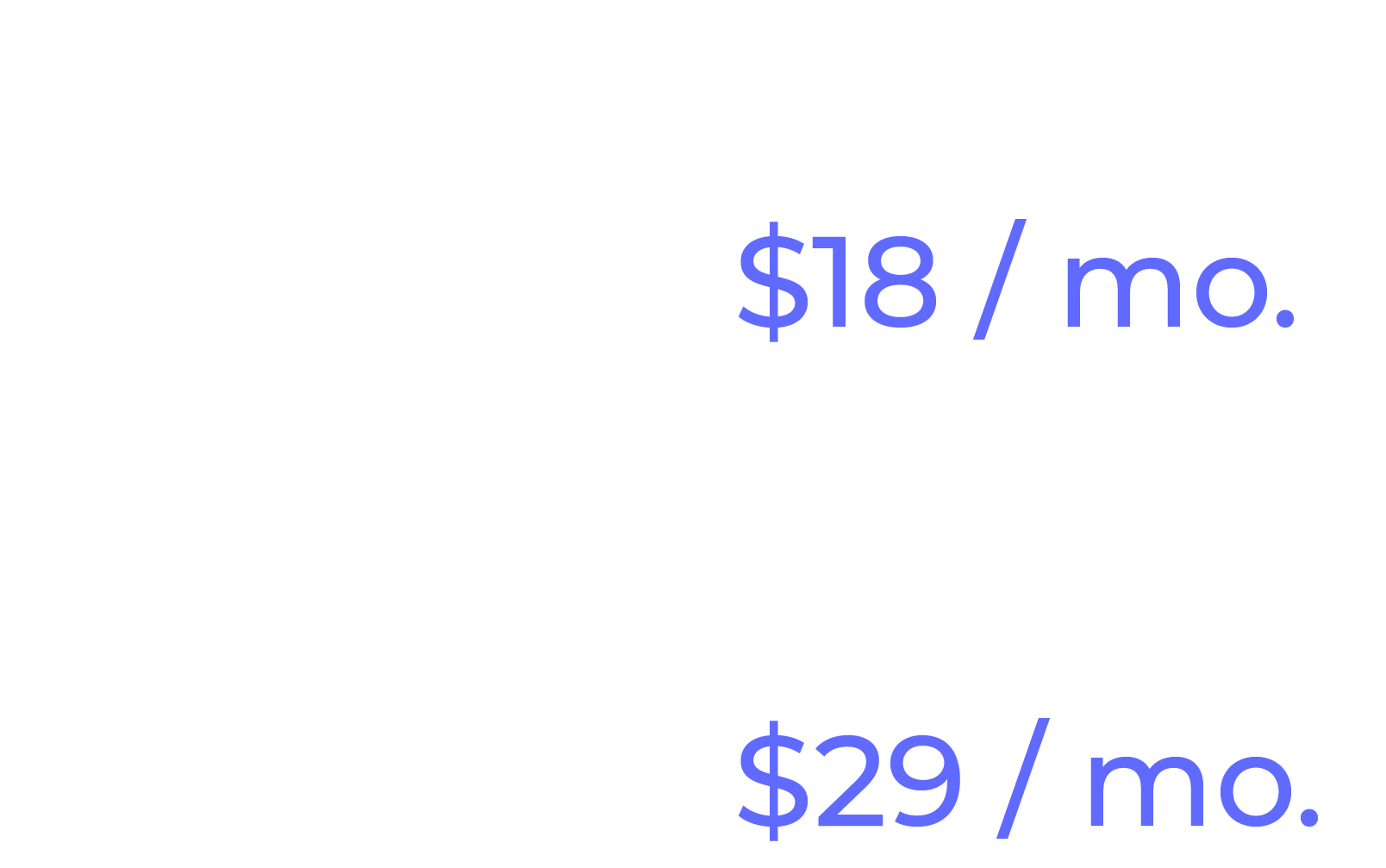

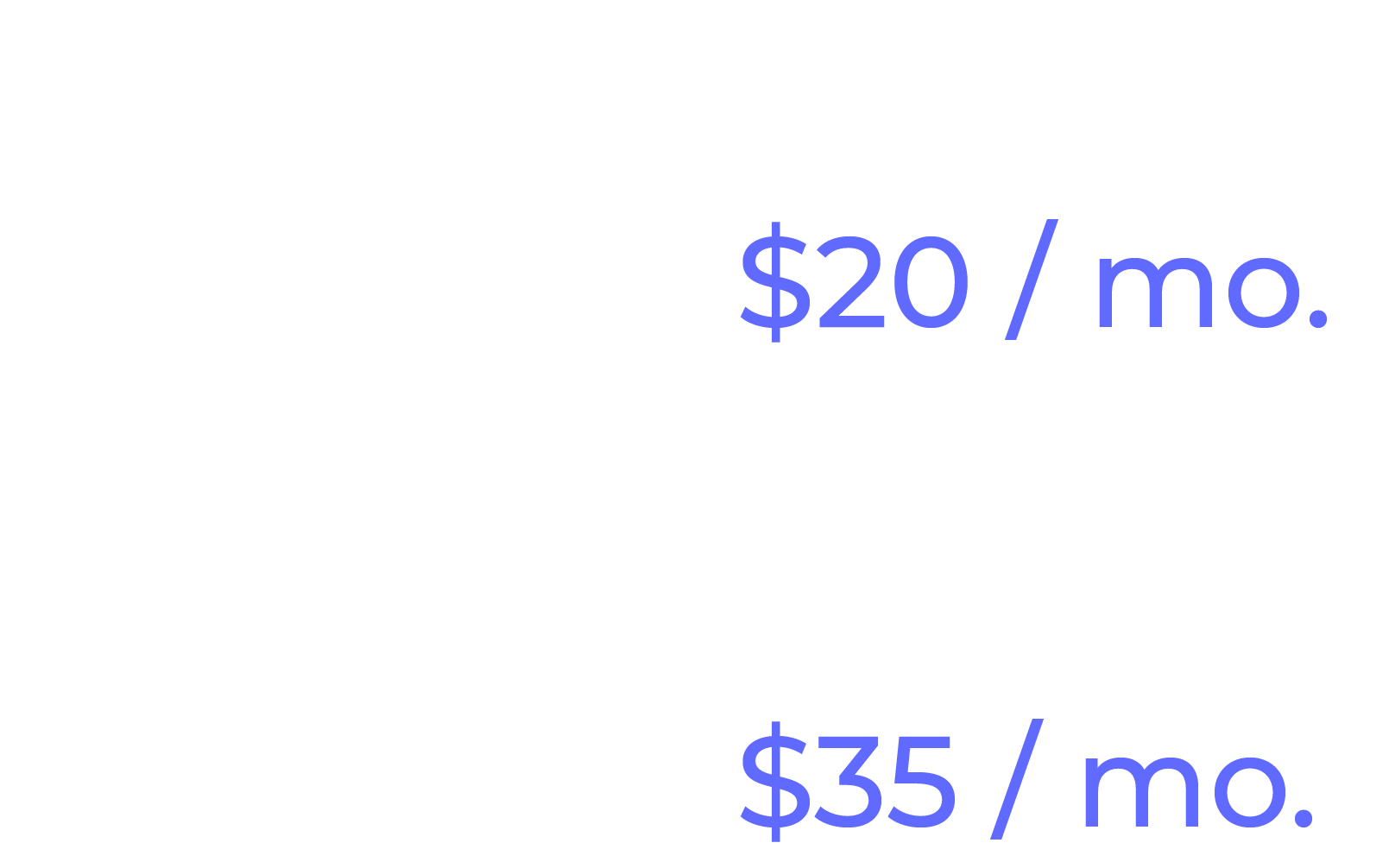

Cost Estimate

For a 40 year old in good health to get life coverage for 20 years. Your cost and eligibility may vary based on your health and other factors.

Get Real Answers

Download the 14 Most Commonly Asked Questions About Life Insurance, For Free!

Frequently Asked Questions

Why do I need life insurance?

Life insurance helps protect the people you care about most. If you pass away unexpectedly, it can cover funeral expenses, pay off debts, replace lost income, and provide a financial cushion for your loved ones.

How do I calculate the right amount of coverage for my situation?

A good rule of thumb is 10‚15 times your annual income, but you should also consider any debts, your family‚ living expenses, and future financial goals like college or retirement.

What determines the cost of a policy?

Premiums are based on your age, health, lifestyle (like smoking), coverage amount, policy type, and term length. The younger and healthier you are, the lower your rates will be.

What information will I need to provide?

You’ll typically need to share some personal info like your age, gender, occupation, health history, medications, and any risky hobbies or lifestyle choices.

Can I change my coverage later?

Many policies allow you to increase coverage, convert to permanent insurance, or add riders as your needs change. It’s best to review your policy every few years.

Can I name anyone as my beneficiary?

Yes, you can name a spouse, child, friend, business partner, or even a charity‚ as long as they have an insurable interest in your life.

What is a life insurance rider?

A rider is an optional add-on to your policy that provides additional benefits or coverage for specific situations.