Whole life insurance

Whole Life Insurance for a Lifetime of Peace of Mind

Some things in life are worth keeping forever. Whole life insurance is one of them.

Unlike term life policies, which eventually expire, whole life insurance offers permanent coverage that lasts your entire life. It’s a smart option for those who want to build long-term financial security, leave a legacy, and gain the added benefit of cash value growth over time.

At Real Innovation, we help you understand your options clearly and connect you with policies that offer real value, not just buzzwords.

What Makes Whole Life Different?

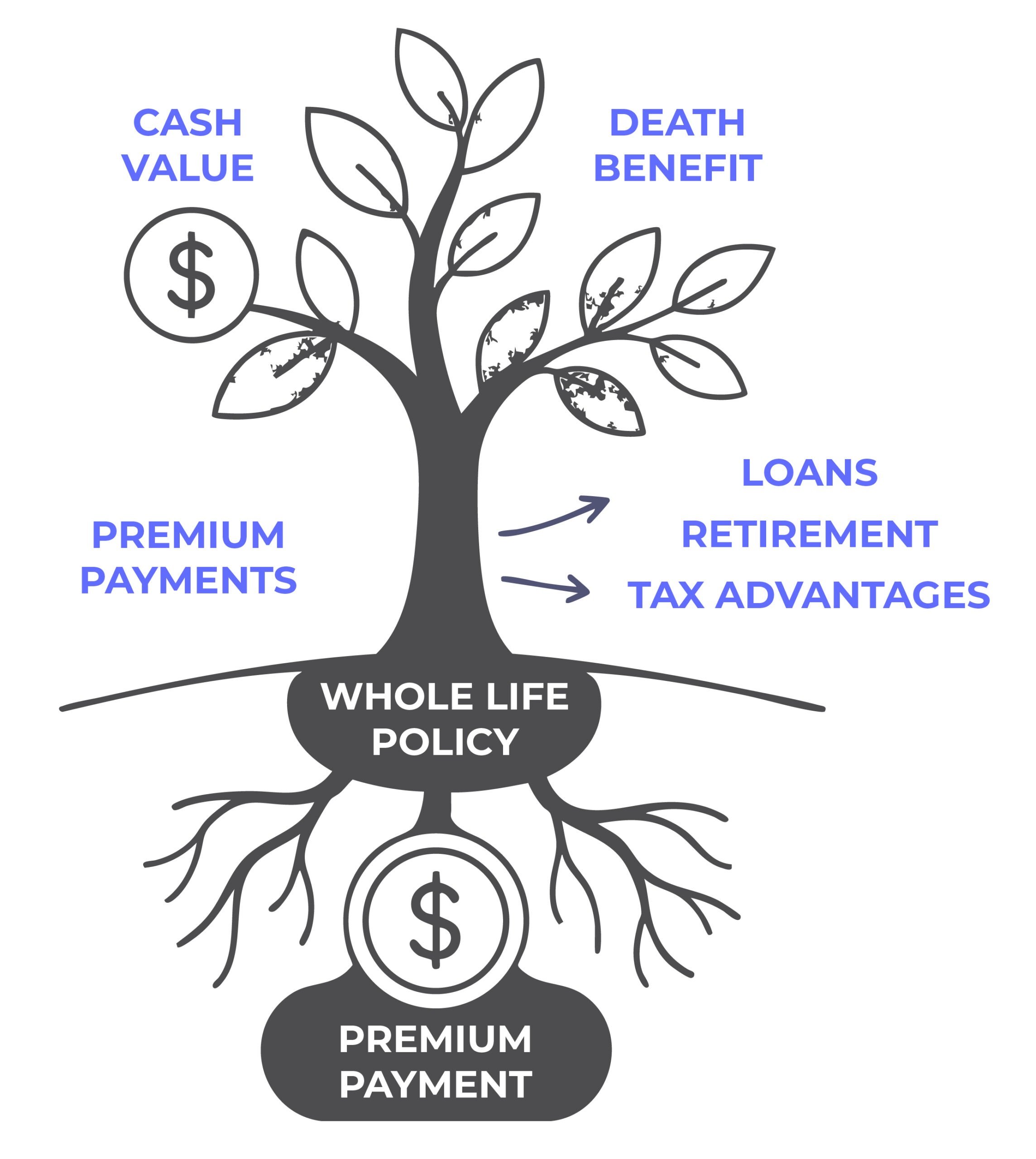

Whole life insurance is a type of permanent life insurance that never expires, as long as you keep up with premiums. In addition to offering a guaranteed death benefit, it builds cash value, which acts like a private savings account inside your policy.

You can borrow from this cash value or even use it later in life to help supplement retirement income, pay for emergencies, or fund major life expenses. Plus, your premium stays fixed for life, so no unexpected increases down the road.

Who Should Consider Whole Life?

Whole life may be the right choice if you:

- Want to guarantee lifelong protection for your family

- Are interested in building tax-deferred savings as part of your financial strategy

- Have long-term responsibilities such as a special-needs dependent

- Are planning for estate taxes or wealth transfer

- Prefer a set-it-and-forget-it approach to life insurance

- Want the peace of mind that your policy will never expire

Real Innovation’s Approach to Whole Life

We believe permanent protection shouldn’t come with permanent confusion. Our platform breaks down whole life insurance into clear terms, so you can make informed decisions with confidence. Here’s how we make it easier:

-

-

- Access to multiple trusted insurance partners

- Transparent comparisons and real-time policy matching

- Support from licensed, non-pushy agents

- Digital tools to track and understand your policy’s value over time

-

We don’t just help you buy a policy we help you understand how it works, what it’s worth, and how to use it when life changes.

Whole Life Insurance & Cash Value Growth

Every time you make a premium payment, a portion is allocated to your cash value account. This account grows over time (at a guaranteed minimum rate), can be accessed through loans or withdrawals, provides added flexibility in retirement or emergencies, and is not subject to market risk.

It’s one of the most versatile features of whole life coverage and one reason many high earners and business owners use it as part of their long-term strategy.

Let’s Be Real…

Life doesn’t come with guarantees. But your coverage can.

Whole life insurance gives you certainty, value, and lifelong protection with none of the guesswork.